Patent analytics and valuation – only relevant for large corporations with huge portfolios, sufficient resources, and plenty of time? No! Patent analytics are particularly beneficial for universities’ innovation or patent departments, small- to medium-sized firms, start-ups, and spinoffs.

Patent Analytics and Valuation for large Corporations only? Universities, SMEs, Investors, and Start-ups may benefit too… But how?

Tags: Mergers and Acquisitions, Patent Analysis, Patent Valuation, Innovation, Patent Quality, Benchmarking, "SMEs", Investors, Universities

European Commission’s DG-Comp Relies on LexisNexis PatentSight when Evaluating Anti-trust Cases in Mergers

In an international tender, the EU Commission’s Directorate-General for Competition selected LexisNexis® PatentSight® and its business intelligence analytics software as the patent data and patent analytics provider.

Tags: Technology, Science, Mergers and Acquisitions, IP Data Quality, Patent Analysis, Patent Valuation, Innovation, Patent Asset Index, Regulation, Benchmarking, trend scouting, mergers, Merger Control, EU Commission, Competition Control

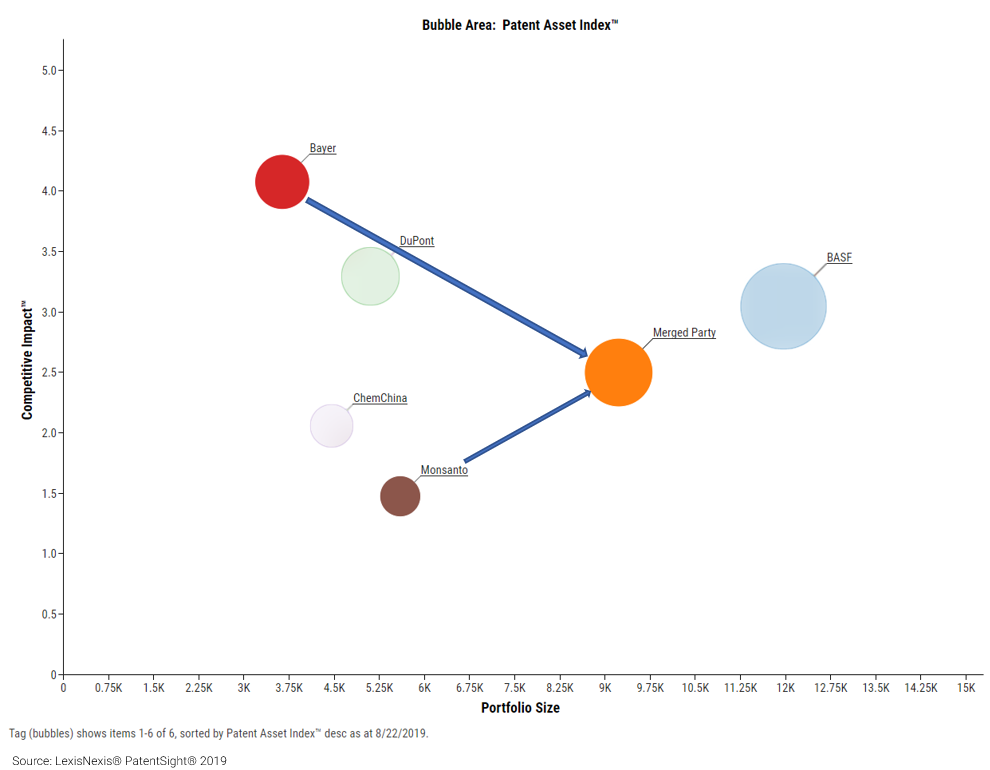

Innovation in merger analysis - How the EU Commission evaluated the case of Bayer-Monsanto

In September 2016, the German drugs and chemicals group Bayer announced its intention to acquire the multinational Monsanto, known for its Roundup herbicide and GMOs. This merger would produce the world’s most powerful company in the seed and pesticide industry. On 21 March 2018 the EU commission released a Press Release announcing their approval of the acquisition of Monsanto by Bayer. The merger was approved on the conditional divestiture of an extensive remedy package, which addresses the parties' overlaps in seeds, pesticides and digital agriculture. It is for determining such inconspicuous aspects of a merger, like technology overlap, that the EU commission relied on the LexisNexis® PatentSight® database and our award-winning Business Intelligence software solution.

Tags: Technology, Science, Mergers and Acquisitions, Patent Analysis, Patent Valuation, Patent Asset Index, Patent Quality, M&A, Merger Evaluation, EU Commission, Competition Control

Patent Portfolio Analysis of proposed FCA and Renault merger

The Press Release of FCA’s proposal for a ‘transformative merger’ with Groupe Renault brings forth the possibility of major change of scenario in the global automotive industry. The proposed merged entity is to be split equally between FCA and Renault shareholders. The merger is expected to allow the combined companies to have greater market coverage in terms of span of automotive technologies and global presence. As claimed by FCA, a noteworthy point in this proposal is the predicted incremental value expected to be routed to Nissan and Mitsubishi as members of the Renault-Nissan-Mitsubishi alliance.

Tags: Technology, Mergers and Acquisitions, Patent Valuation, Future, chrysler, car manufacturers, renault, fiat chrysler, fiat, mitsubishi, nissan, automotive industry, mergers

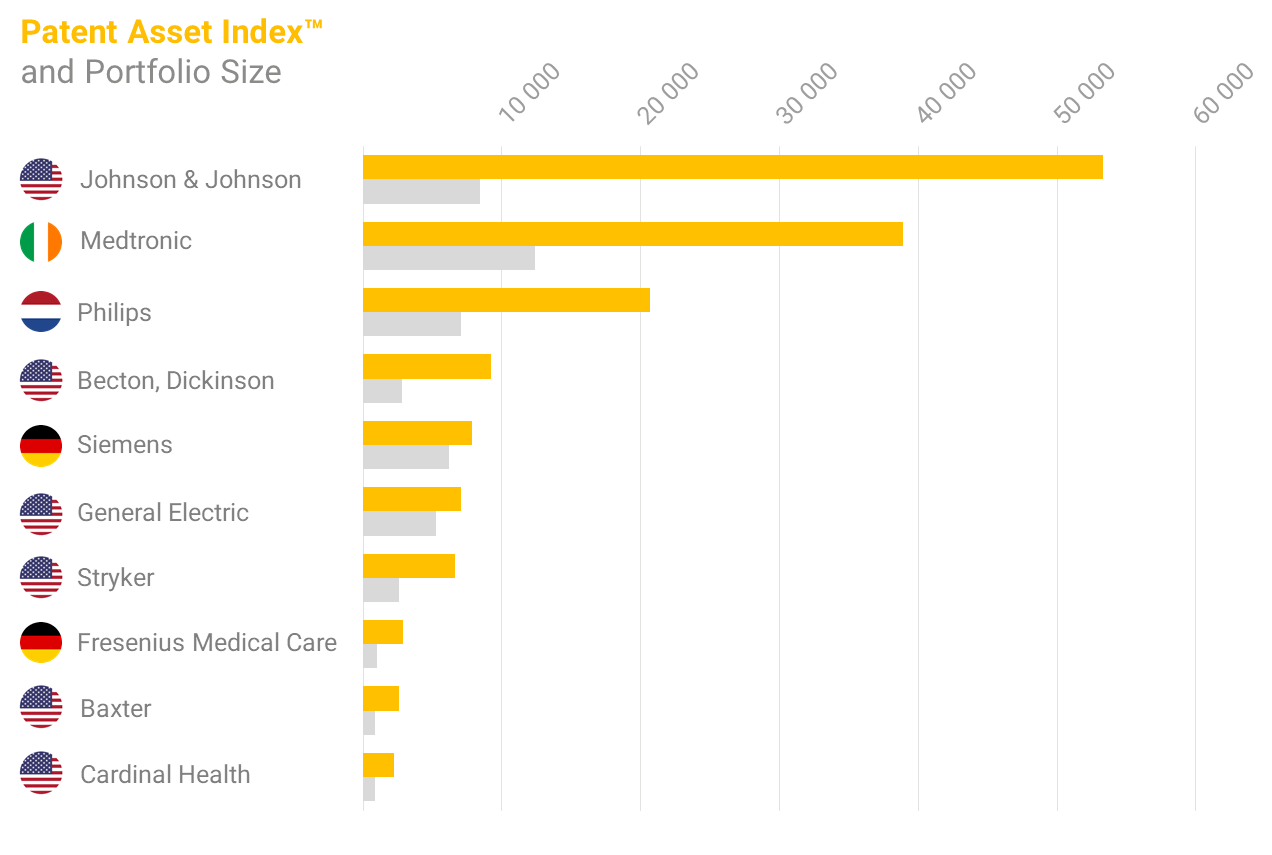

Insights into Medical Technology Field in light of planned GE Healthcare IPO

Ranked among the top 10 global medical device companies as of revenue, General Electric is now about to file for an IPO to spin out its health-care unit GE Healthcare, as reported by CNBC. With the ongoing jump of Siemens Healthineers shares after their $5 Billion IPO, now GE Healthcare has caught the attention of investors in the medical device market. In this context, PatentSight shed light on the global top 10 medical device companies as of revenue in 2017 from a patent perspective.

Tags: Mergers and Acquisitions, IP Data Quality, Patent Valuation, Patent Asset Index, IPO Analyses

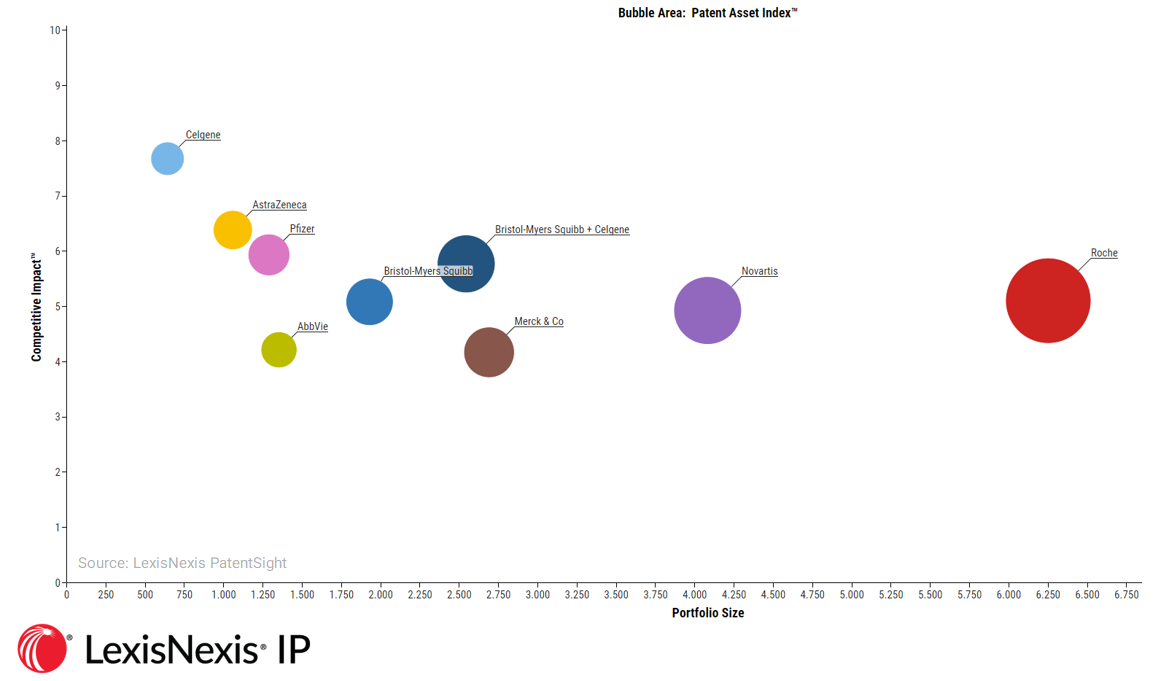

Patent analysis reveals opportunities and concerns around the Bristol-Myers Squibb/Celgene merger

In January of this year, U.S. pharmaceutical manufacturers Bristol-Myers Squibb (BMS) and Celgene Corporation announced they had entered into a definitive merger agreement for BMS to acquire Celgene.

The stated aim of the merger is to create ‘a premier innovative biopharma company’ with a particular focus on building an expanded offering in the cancer and immunotherapy space. If completed, the transaction is expected to cost $74 billion in a cash and stock deal, whereby Celgene shareholders will receive 1.0 BMS share as well as $50 in cash for each share of Celgene.

Our analysis of the two firms’ respective patent portfolios provides insight into how this merger would affect the U.S. pharma market. For this analysis, we employed our Patent Asset IndexTM methodology, which scientifically assesses patent families against Key Performance Indicators of Technology RelevanceTM and Market CoverageTM.

Tags: Science, Mergers and Acquisitions, Patent Analysis, Patent Asset Index

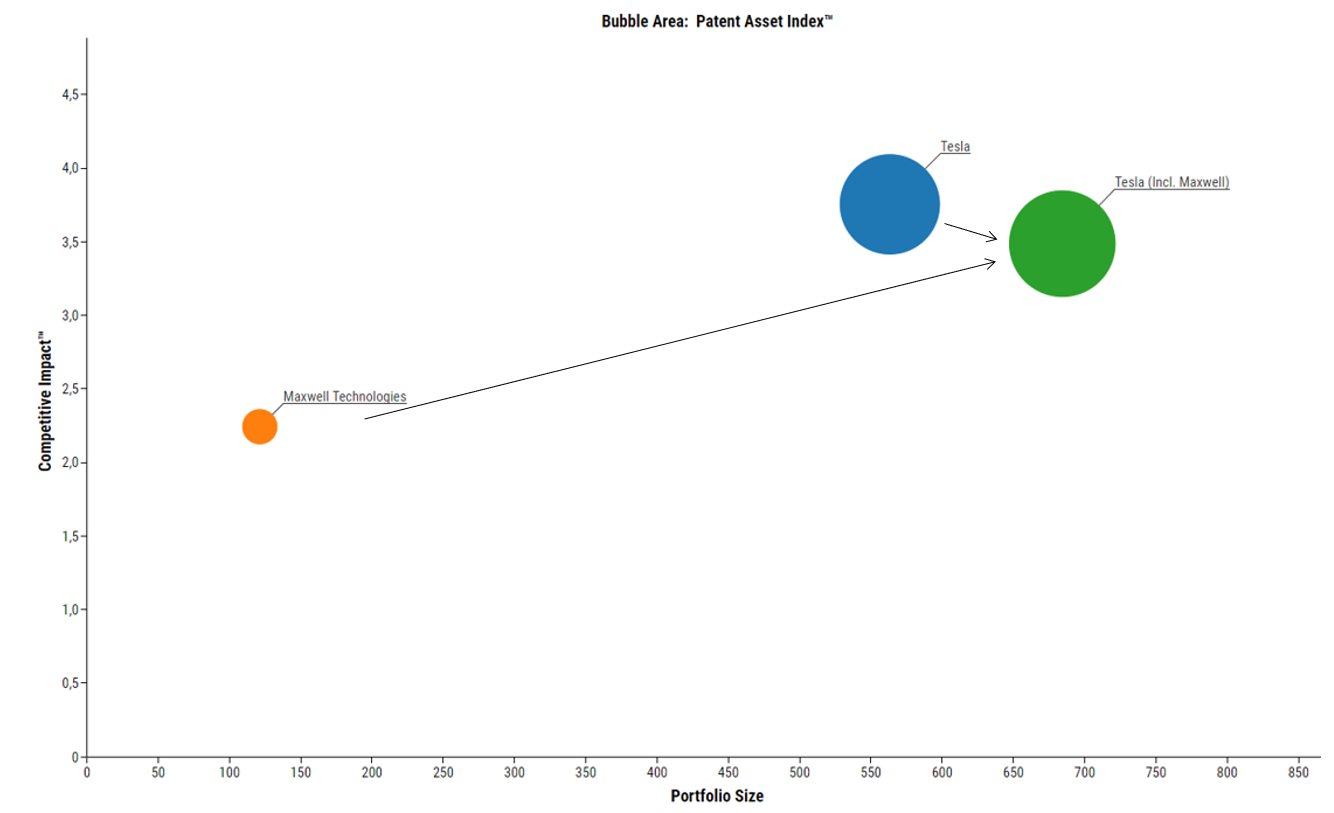

Tesla to buy Maxwell Technologies: an important technological edge in the battery market for electric cars

With the acquisition of Maxwell Technologies, Tesla expands its patent portfolio and includes technologies that may lead to a major advantage in the future technology of efficient batteries for electric cars. The company is a specialist in the field of energy storage. For Tesla this can mean a leap forward in the highly competitive field of battery technology for electric cars. A closer look at this acquisition scenario shows us in which technology areas Maxwell can significantly complement Tesla's patent portfolio.

Tags: Technology, Mergers and Acquisitions, Patent Analysis, Innovation, Patent Asset Index

You may have seen our recent press release but I wanted to personally express my excitement over the recent acquisition by LexisNexis® IP. We anticipate that as a result of this acquisition, we will be able to make significant enhancements to our product.

With added content, financial resources, and a broader customer base we will significantly accelerate our development. In particular, the advent of powerful self-learning algorithms often described as “artificial intelligence” is a great opportunity to reach the next breakthrough in patent analytics. We are thrilled to leverage our competence in high quality data and reliable science-based algorithms to continue leading the field with advanced tools that offer unique and reliable business insights.

Rest assured, many things you value about PatentSight will not change. PatentSight will continue under the leadership of myself and my team in the same offices in Bonn, Germany. All PatentSight employees will be retained and your current points of contact will not change. Our much-praised Consulting & Support Team will continue to serve you directly. The name of the product will change slightly to LexisNexis PatentSight.

We look forward to our continued relationship. Please contact me, Björn Ulmer or your main contact in the business development team if you have any additional questions.

Tags: Technology, Science, Mergers and Acquisitions, IP Data Quality, Patent Analysis, Patent Valuation, Innovation, Patent Asset Index

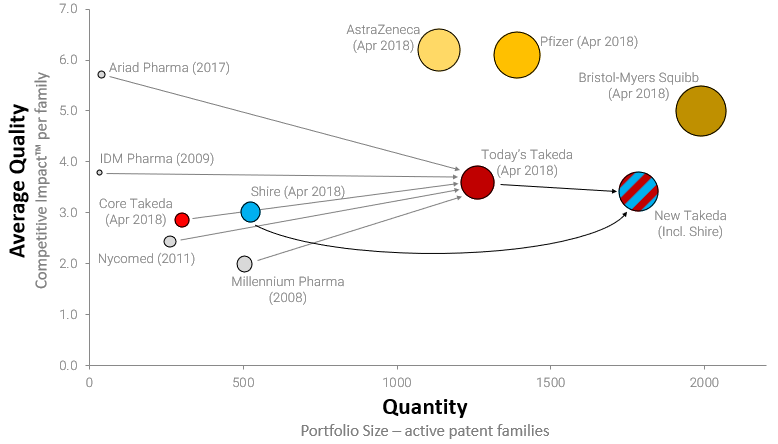

In 2011 faced with “the impending loss of patent protection on certain leading products”, the Takeda Pharmaceutical Company unveiled its mid-term plan to achieve sustainable growth. Over the 10 years prior to this Takeda had pruned its patent portfolio significantly from over 3500 patent families in the year 2000 to less than 1900 in 2008, saving the company millions of dollars over the lifetime of these patents. Whilst such cost saving measures would have reduced the company’s liabilities, this alone would have not ensured long-term prosperity. Enter the “New Takeda”.

Tags: Mergers and Acquisitions

Becton Dickinson secures itself as a healthcare innovation leader with Bard acquisition

Becton Dickinson’s 24bn USD acquisition of U.S. peer C.R. Bard, as reported by Reuters, has secured its position as one of the top 10 global healthcare companies in terms of both revenue and innovation. Although the combined company will still wield a smaller patent portfolio than the industry giants, the average quality of the portfolio is significantly above average, surpassed only by Johnson & Johnson. This high quality means the combined entity now has 6th strongest portfolio in the field of healthcare, as defined by ip-search a division of the CHPTO, out of the top 30 medical device manufacturers, by annual revenue reported in MPO magazine.

Tags: Mergers and Acquisitions, Innovation, Patent Asset Index, Regulation

Recent Posts

Posts by Tag

- Patent Asset Index (22)

- Patent Analysis (16)

- Patent Valuation (16)

- Technology (15)

- trend scouting (14)

- Deep-dive (13)

- Future (13)

- Mergers and Acquisitions (11)

- solutions provider (11)

- Innovation (10)

- Patent Quality (9)

- Science (9)

- electric vehicles (8)

- BEV (7)

- IP Data Quality (7)

- e-mobility (7)

- electric drivetrain (7)

- electric propulsion (7)

- ev (7)

- Benchmarking (6)

- IPO Analyses (5)

- IP Benchmarking (4)

- big data (4)

- legal status (3)

- mergers (3)

- AI (2)

- Alphabet (2)

- Competition Control (2)

- EU Commission (2)

- M&A (2)

- Regulation (2)

- autonomous driving (2)

- "SMEs" (1)

- American Express (1)

- Apple (1)

- Artificial Intelligence (1)

- BMW (1)

- China (1)

- Competitive Impact™ (1)

- Daimler (1)

- Evolution of AI (1)

- General Motors (1)

- Google (1)

- Investors (1)

- Merger Control (1)

- Merger Evaluation (1)

- PatentSight Summit (1)

- Rare earth metals (1)

- Tesla (1)

- USA (1)

- Universities (1)

- Volkswagen (1)

- automotive industry (1)

- award winning software (1)

- car manufacturers (1)

- card technology (1)

- chrysler (1)

- codie awards (1)

- fiat (1)

- fiat chrysler (1)

- mitsubishi (1)

- nissan (1)

- patent (1)

- patent landscape (1)

- rare earth elements (1)

- renault (1)

- self-driving (1)